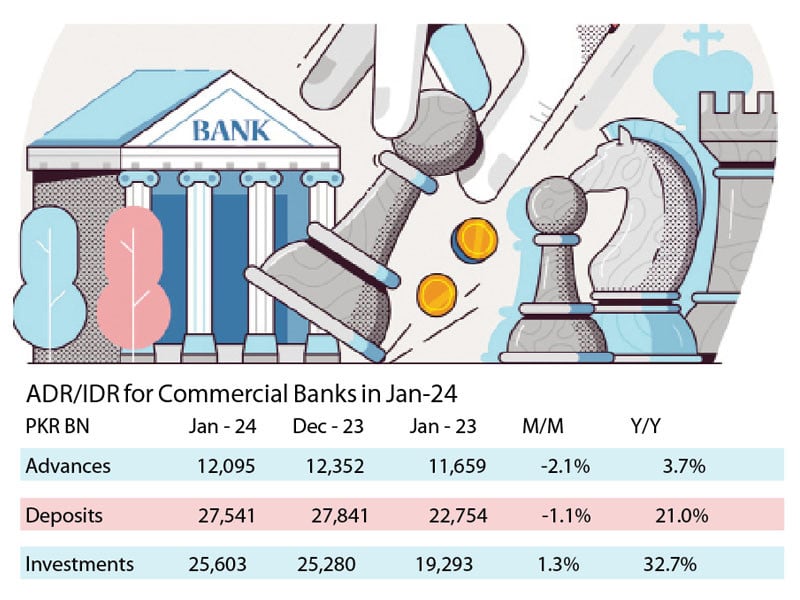

KARACHI: Pakistan’s commercial banks have continued to freely lend to the cash-strapped government at elevated rates of return, taking their financing to a record high of 93% of total deposits in January 2024.

According to data compiled and shared by Optimus Capital Management (OCM), banks’ credit to the private sector, however, remained stagnant at the eight-month low at 44% of deposits in January. Higher inflation and interest rates did not allow businesses to expand their production lines and also set up new factories.

Bank deposits ticked down to Rs27.54 trillion in January compared to Rs27.84 trillion in December 2023, as “rich depositors apparently withdrew cash that they had deposited in December on the request of banks to allow financial institutions to maintain their books with good numbers,” Arif Habib Limited (AHL) economist Sana Tawfik said while talking to The Express Tribune.

She said the government’s reliance on domestic debt was on the rise due to lesser foreign loan inflows for quite a long time.

Data suggests that banks invested Rs25.60 trillion in government debt securities like T-bills, Pakistan Investment Bonds (PIBs) and Sukuk out of the total deposits of Rs27.54 trillion. This led to a rise in the investment-to-deposit ratio (IDR) to the all-time high of 93% in January.

The IDR stood at 85% a year ago in January 2023 and at 91% in December 2023.

Government borrowing from domestic banks is on the rise to finance the fiscal deficit widening primarily due to a significantly high interest cost on debt. The record high policy rate of 22% is estimated to push interest payments beyond Rs8 trillion in this fiscal year.

A one-percentage-point rise in interest rate increases interest cost by around Rs200-250 billion a year. The central bank cumulatively jacked up its key policy rate by 15% between September 2021 and June 2023.

Financial markets hope that the central bank will start slashing the policy rate in March or April this year, which will result in a reduction in interest payments and will encourage private businesses to borrow from banks for their existing and new investment projects.

The government has continued to increase borrowing from commercial banks since the International Monetary Fund (IMF) barred it from taking loans from the State Bank of Pakistan (SBP) in mid-2019. It is believed that central bank lending triggers inflation in the economy.

Credit to private sector

Credit flow to the private sector remained stagnant at Rs12.09 trillion in January 2024 out of the total deposits of Rs27.54 trillion, as a result of which the advances-to-deposit ratio (ADR) stood at 44% for the second consecutive month.

The ADR had been on the wane in the prior eight months and reached 44% in December 2023 compared to 52% in April 2023.

AHL’s Tawfik said the ADR dropped also due to the change in banks’ strategy to accept maximum deposits in the past one year compared to their reluctance to receive more deposits in December 2022.

She recalled that the government had imposed a tax on those banks whose ADR was lower than 50% in 2022. Therefore, the banks increased the ratio through lowering their deposit levels. Later, the government suspended the tax.

Market talk suggested that the tax may be imposed again this year on lower ADR to encourage financial institutions to lend maximum funds to the private sector to ramp up economic activities, she said.

Bank deposits

Customer deposits at banks ticked down in January compared to December 2023. They, however, grew 21% in the past one year to Rs27.54 trillion in January 2024 compared to Rs22.75 trillion in the same month of last year.

Tawfik said bank deposits grew for two major reasons – conversion of workers’ remittances into Pakistani rupees and soaring government debt taken from local banks. Both the transactions are shown in deposits. The local relatives of overseas Pakistanis who send funds back home deposit them in banks.

She pointed out that the government borrowed from banks for deficit financing but the money continued to remain parked in banks, which inflated the deposit size.

Negative return

The excessive lending to the government is sometimes made through bank borrowing from the central bank.

Sometimes banks make expensive borrowing from the central bank at over 22% and lend to the government at a rate less than 22%, taking a hit on their returns, which become slightly negative.

However, banks made most of the lending through deposits and partially meet the government financing requirement through borrowing from the central bank.

Tawfik said banks were doing so on expectation that the central bank would soon cut interest rate, which would turn margins positive.